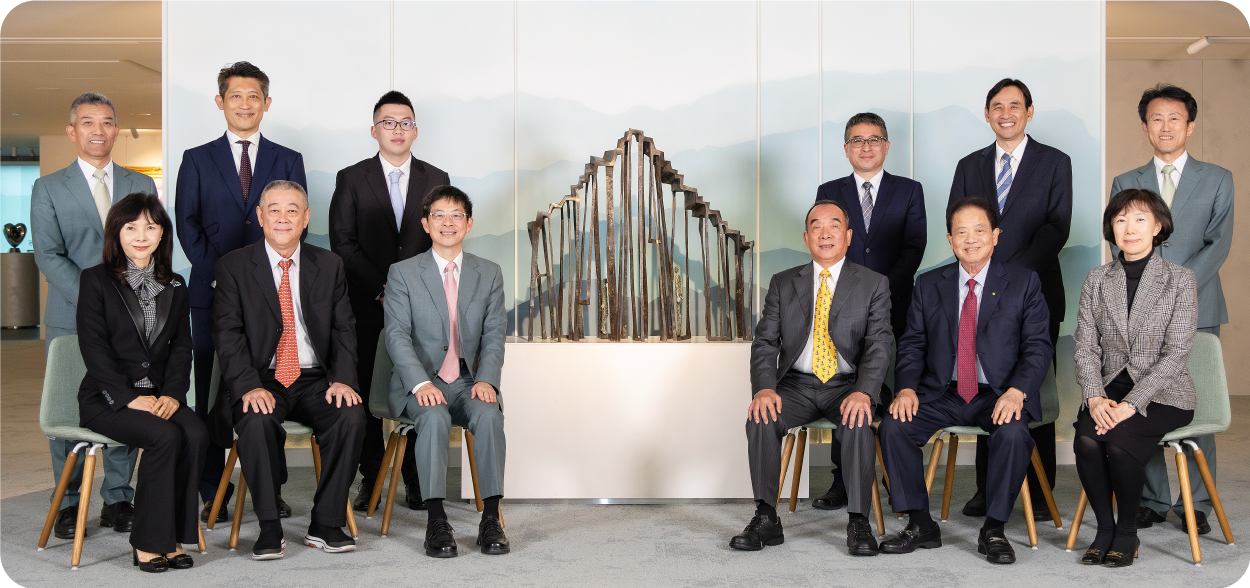

E.SUN FHC has a complete director selection system. Based on the company's industrial characteristics and future development strategies, it carefully considers the configuration and diversification standards of the board of directors. The board of directors is composed of financial industry, industry circles, scholars and experts. All 5 independent directors with different professional backgrounds are equipped with the knowledge, skills, literacy, and skill sets necessary to perform their duties. The level of female involvement in decision-making will be increased in accordance with the principle of diversity in the future. Diversified background information as shown in the figure:

| Procedure | Explanation |

|---|---|

| Nomination of directors |

|

| List review |

|

| Shareholders vote |

|

| Job Execution and Evaluation |

|

Depending on the expertise of the directors, they are invited to participate in the discussion and guidance of specific issues.

To ensure an effective Board of Directors and refine the quality of board decisions, various functional committees are created by authority and function under the Board of Directors and are responsible for deliberating proposals and major issues in the economy, the environment, the society and risks. The functional committees are composed or participated by independent directors, so that the committee's decision-making and recommendations are forward-looking, objective and comprehensive, effectively implement the mechanism of independent supervision and checks and balances, and ensure that all resolutions and actions of the board of directors are put forward. All important proposals of the functional committees are reported to and discussed in the Board of Directors meetings. Directors ask questions and provide suggestions regarding the aforementioned proposals during the meetings. In addition to full discussion, the directors also inspected and supervised the implementation of the plan from the perspective of various implementation progress, and urged the management team to make adjustments in due course. The director who have an interest in himself or the legal person he represents should recuse himself from the discussion. Some important proposals are also submitted to the shareholders‘ meeting for report and discussion to ensure the best interest of the interested party. Additionally, in response to the development of digital finance and to strengthen professional support for the Board of Directors, a Technology Advisory Board was newly established as a general committee of the Board of Directors in June 2023.

| Name | Times | Average Attendance Rate (%) | Members | Independent directors | Frequency |

|---|---|---|---|---|---|

| Board of Directors | 9 | 99.07 | 12 | 5 | Be held at least quarterly |

| Audit Committee | 7 | 100 | 5 | 5 | Be held at least quarterly |

| Corporate Governance and Nomination Committee | 4 | 100 | 7 | 5 | Be held at least twice a year |

| Remuneration Committee | 3 | 100 | 5 | 5 | Be held at least twice a year |

| Board Strategy Development Committee | 2 | 100 | 10 | 5 | Be held at least a year |

| Sustainable Development Committee | 4 | 100 | 5 | 3 | Be held at least twice a year |

| Risk Management Committee | 5 | 100 | 5 | 3 | Be held at least quarterly |

The 2024 shareholders' general meeting will be held physically and assisted by video, providing shareholders with multiple channels for exercising their rights. In addition to continuing to proactively report proposals such as "specific promotion plan for sustainable development", "communication between the Audit Committee and the head of internal audit", amended "the regulation of Asset Acquisition or Disposal Procedures " to require that related-party transactions for acquiring or disposing of assets be reported to the shareholders' meeting, in order to strengthen the management of related-party transactions. In order to protect the rights and interests of shareholders and implement equal treatment of shareholders, insiders are expressly prohibited from using undisclosed internal material information to buy and sell securities, and insiders and directors who are informed of financial reports or performance contents are not allowed to trade their stocks during the closed period, and the relevant controls on stock trading are indeed established. Management measures and inspection and confirmation mechanism.

In 2024, each director will receive an average of 10.92 hours of training, which is higher than the legal recommendation. E.SUN annually plans the educational topics for the board of directors' training programs by referencing changes in internal and external environmental conditions and development needs. For example, in 2024, the focus will be on gender equality education and prevention of sexual harassment to further enhance the board's awareness of gender issues, thereby fostering a gender-friendly workplace environment. Additionally, we periodically provide directors with information about diverse course offerings from training institutions, assessing their professional backgrounds and needs to increase course arrangements. This is to fulfill the fiduciary duty of diligent business execution and good management, thereby maximizing operational decision-making and leadership oversight functions.

| Training course | Training hour |

|---|---|

| Impact of the Internal Ratings-Based Approach of the Basel Accord on Capital Management | 2 |

| Trends and Developments in Anti-Money Laundering Supervision at Domestic and Foreign | 3 |

| AI and Treat Clients Fairly | 3 |

| Technological Governance and Sustainable Development | 3 |

The Company completed the 2024 board and functional committee performance evaluation. The results are presented below:

The functional committees served their purposes as intended, effectively making the board more effective. The Company presented the results of the 2024 director performance evaluation on February 14, 2025, based on self-assessments conducted by the directors themselves and peer reviews

The Company has been devoted to planting corporate governance culture in the company system and daily operation. The Company has commissioned external professional organizations to conduct performance evaluation on the board every three years and to execute corporate governance evaluation certification every two years. In 2018, 2020, 2022 and 2024, the Company was awarded the CG6011 (2017), CG6012 (2019), CG6013 (2021) and CG6014 (2023) the corporate governance system evaluation, "exceptional" certification, and the relevant recommendations were listed as priority corporate governance improvement plans.