Responsible Lending

Sustainable Lending Business

E.SUN has been a long-term supporter of environmentally and socially sustainable industries. In order to respond to international trends and domestic policies we continuously support businesses in investing in green projects such as renewable energy, energy storage systems, green buildings, and energy-efficient equipment through green loans and sustainability-linked loans while encouraging them to achieve their sustainability transformation goals.

Balance unit: NT$ million

| Sustainable lending | Balance as of 2022 | Balance as of 2023 |

|---|---|---|

| Green loans | 53,741 | 80,926 |

| Sustainability-Linked Loans | 40,642 | 60,062 |

| Total value of sustainable lending | 94,383 | 140,988 |

| Total value of corporate lending* | 866,051 | 904,244 |

| Percentage over total corporate lending | 10.90% | 15.59% |

*The overlapped amount has been deducted when calculating the total value.

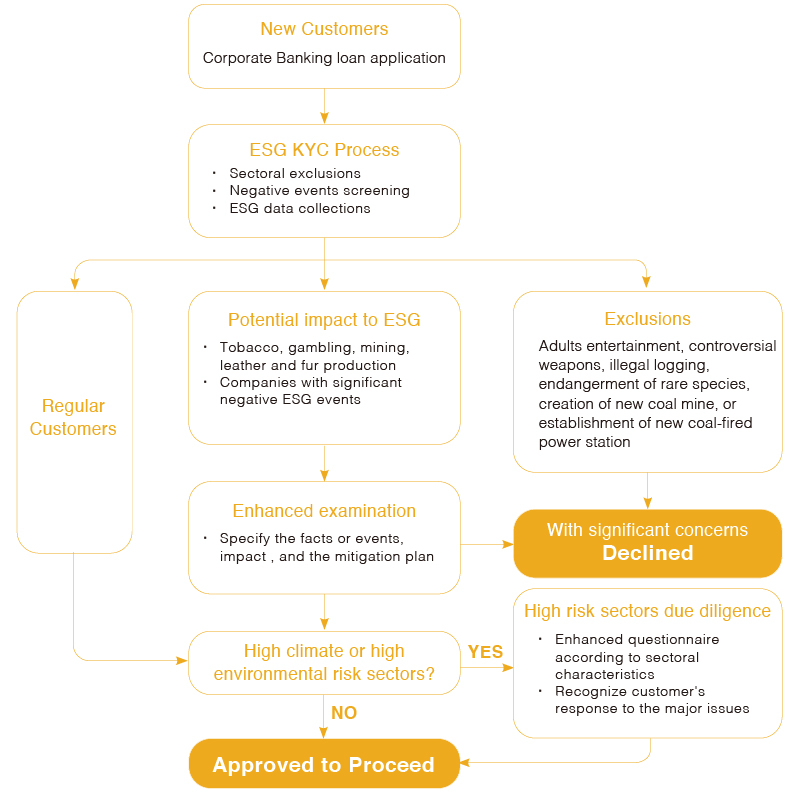

Credit ESG-related risks management

E.SUN has developed a responsible loan service process taking into consideration potential ESG-related risks. Each credit application undergoes an ESG assessment, including checks on sensitive industries, significant environmental and social negative events, climate risks, and environmental ones. If a credit applicant is deemed high-risk, further investigation is conducted to understand the company's responses and remedies. Besides, E.SUN became a member of the Equator Principles in 2015 to assess project finance cases, such as large-scale infrastructure projects. Following the latest Equator Principles framework, we evaluate each relevant project to ensure that higher-risk projects implement environmental and social management throughout the development process.

Sustainable Transformation Services

Hoping for more corporates to respond to ESG issues, E.SUN offers information on net-zero and sustainable transformation to corporate clients through various initiatives, including advocacy campaigns, corporate ESG consultation and engagement, as well as net-zero discussions. In addition, E.SUN collaborate with professional institutions in net-zero and sustainability to establish a sustainable transformation platform providing industry workshops, ESG checkups and other services coupled with financial services like green loans and sustainability-linked loans, in order to collaboratively accomplish green transition alongside clients.

Sustainable Investment Business

Responsible Investment

Responsible Investment

E.SUN promotes the long-term value of our customers, employees, and shareholders, aiming to foster collaboration with our business partners along the value chain to work together on climate change, environmental protection, and social welfare. Referencing the Principles for Responsible Investment (PRI), E.SUN incorporates environmental, social, and corporate governance (ESG) issues into the investment policy and utilizes domestic and international sustainability indicators of impartial institutions for assessment and management procedures to integrate these factors into self-developed investing evaluation model as part of the investment decision-making process. As the first financial institution in Taiwan and the second in Asia to receive validation of Science Based Targets (SBT), E.SUN included SBT carbon reduction target reviews and carbon pricing costs into the model evaluation criteria in 2022, continually aligning with international development trends.

Sustainable Bond

Sustainable Bond Issuance

E.SUN continues to invest in environment- and community-friendly industries. Following the issuance of the country's first green bond in 2017, E.SUN adopts a financial management strategy that integrates the concept of sustainable development, the funds raised are lent to support green investment plans involving renewable energy, greenhouse gas reduction, and water resource conservation, as well as socially beneficial investment plans such as basic service requirements, affordable housing, socioeconomic advancement, and protection of interests and rights. E.SUN aims to leverage our financial influence to make a positive impact.

Sustainable Bond Underwriting

E.SUN fully supports the government's sustainable development policies by integrating sustainability concepts and principles into our core financial business. We assist enterprises in sustainable financing, channeling funds into activities that benefit the environment and society, continuing to expand the underwriting volume of sustainable bonds, and thus exerting our influence in the capital market.

Retail Banking & Financial Inclusion

Retail Banking

Responsible products

E.SUN prioritizes environmental conservation and social care, integrating ESG principles into our retail products. We offers a diverse range of sustainable initiatives, including sustainable mortgages and loans, ESG credit cards, etc.

Sustainable communication and engagement

To encourage more people to practice green living, E.SUN motivates customers to support businesses through green consumption. Moreover, we also engages with customers to fulfill sustainability commitments.

Financial Inclusion

Inclusive financial products

E.SUN designs affordable loans, insurance, and trust financial products tailored for micro-enterprises, economically disadvantaged groups, seniors, and youth. These products aim to lower the barriers to accessing financial services.

Inclusive financial services

To create a more financial-friendly environment, E.SUN provides accessible financial services through both physical and digital channels for seniors, youth, residents of remote areas, individuals with disabilities, etc.

Cultivate financial literacy

Through promoting financial education, providing business management tools, encouraging savings, and more, E.SUN assists small and micro enterprises as well as individual customers in establishing basic financial literacy and building financial resilience.

Wealth Management

FinTech and Innovation

Services Supported

Digital foundation

Capitalizing on the technological capacity of E.SUN, we continue to develop infrastructures for digital transformation and endeavor to fulfill our sustainability commitments by adopting eco-friendly practices, conserving energy, and creating the value of environmental sustainability.

| Topics | Strategy Directions |

| AI Technology | MLaaS (Machine Learning as a Service) platform already hosts over 100 AI services, allowing for rapid and flexible deployment and utilization of AI model APIs. It has become a vital bridge connecting mature AI models and business systems. |

| The establishment of the GENIE platform provides E.SUN staff with a single interface for using generative AI. In the wave of emerging technologies, it ensures information security, compliance, and budget management. | |

| Operational Resilience | Proactively prepares for potential extreme scenarios in the future by leveraging the advantages of the cloud. In 2023, we promoted the backup of critical system data to the cloud. |

| In order to enhance the availability of overseas information systems and reduce the impact on services in overseas branches, E.SUN had completed the migration of servers in our Singapore branch to the public cloud by 2023. We will also continue to plan and promote the migration of servers to the public cloud in other overseas branches. | |

| Resource efficiency | To achieve optimal allocation of information resources, we provide services through virtualized environments and private clouds. We also implement monitoring and management tools to collect and analyze resource usage trends for flexible resource scheduling. |

| In order to increase productivity, we implement the collaboration platforms in development process and digital tools. | |

| To enhance resource utilization efficiency, we have implemented a new form of wide area network (WAN) connectivity architecture called SD-WAN (Software-Defined Networking in a Wide Area Network). We have adjusted the existing network infrastructure in overseas branches and strengthened the integration and utilization of existing network connections. | |

| Agility and Resilience | We have expanded the usage of container platforms since 2022. In addition to providing flexibility in leveraging public clouds, this expansion will enable rapid application delivery, automated deployment, and operations. Container technology also allows for automated scaling to enhance system reliability, ensuring uninterrupted application services. |

| Cloud Service has the diversity and high availability, and complement with on-premises services, more information service requests will be achieved by using both cloud and on-premises service. At the same time, the security of using cloud services is ensured through a security management framework. | |

| Security Monitoring | E.SUN continues to benchmark the supervisory configuration rules proposed by the competent authorities to expand the scope of abnormal behavior detection, and utilizes automatic threat intelligence collection to improve the efficiency of threat intelligence process, further reducing manual processing costs and increasing risk identification. |

Protecting Patented Technology

As a pioneer of financial technology and digital transformation, E.SUN adopted the Taiwan Intellectual Property Management System (TIPS) in 2020, and passed the TIPS A-Level verification. Through intellectual property risk assessment, patent proposal review mechanism, proposal rewards, intellectual property-related advocacy education, and talent training, E.SUN implements intelligent services and technical advantages.

E.SUN's patents cover areas such as data control and information security, identity verification, payment, AI application, interface design, and more. These innovations are applied to create innovative financial services, providing customers with convenient, fast, and secure experiences. Our significant digital business proportion leads Asian financial banks. E.SUN will continue to protect the intellectual property rights of various core businesses, strengthen the business development foundation, and promote corporate governance to move towards sustainable development.

Financial Innovation Applications

| Unified Application Platform | In the past, customers usually had to apply for multiple financial products to meet their shopping, investment, and travel needs. With the customer's needs at the core, E.SUN launched the new generation "Unified Application Platform" in December 2023. Customers can fill out their information only once according to their own needs and complete up to 7 financial service applications simultaneously. This includes applications for TWD and foreign currency accounts, credit cards, personal loans, mortgage loans, securities accounts, and sub-brokerage accounts. The platform also automatically completes account linking and settlement, eliminating the need for repetitive applications or in-person visits. This one-stop service saves time on tedious and repetitive application processes, solving the inconvenience of daily financial services and allowing customers to easily enjoy E.SUN's high-quality digital services. |

| Corporate Online Application Platform | In order to enhance the digital loan experience for businesses, E.SUN has created the "Corporate Online Application Platform." Business owners and enterprises can fill out credit application forms, agree to credit inquiries, and apply for credit guarantee fund loans through a variety of identity verification mechanisms. The platform is also integrated with business registration services, reducing the need for customers to input redundant information and addressing pain points in the application process. Subsequently, cases are automatically assigned to the corresponding account managers based on the attributes of the businesses. This integration of virtual and physical channels reduces the cost of manual operations for employees. |

| Embedded Financial Services | By linking with preferred partners such as convenience stores, communities, and chain brands, E.SUN integrates banking services into customers' daily life scenarios, enhancing the customer service experience. In 2023, a total of 5 scene integrations were completed, including data sharing with PLUSPay for "personal loans and account opening services", "account opening and linking services" with PLUSPay and PXPay, integration of account payment for management fees through the Smartdaily App, embedding the E.SUN foreign currency balance inquiry in the PLUSPay travel section, and providing exchange rate inquiry services. With a customer-centric approach, E.SUN utilizes API modules to build microfinance services and scene ecosystems. |

| Mobile Banking | Integrating multiple innovative services within the bank, E.SUN Mobile Banking has obtained multiple patents and has an active user base of around 70%. In 2023, we will continue to focus on enhancing the customer experience and providing diverse services, including:

(1)Diverse authentication modules: To ensure the security of customer transactions, E.SUN provides 12 authentication methods, including FIDO authentication (added in 2023), voice OTP, SIM card authentication, ATM verification codes, and facial/fingerprint recognition. E.SUN has obtained 2 invention patents and 5 utility model patents. In 2023, it was also approved by the government for financial innovation investment deduction. Customers can choose suitable authentication according to their own needs, providing a more flexible and secure service experience. (2)Upgrade of foreign exchange services: In 2023, the foreign currency trading interface was integrated, and a new service for reserving foreign currency transactions was added. In addition, there are 15 types of foreign currency available for online buying and selling services 24/7. Customers who need to travel or go on business trips can exchange currencies at any time, enjoying a simpler, smoother, and more considerate digital financial experience. The overall proportion of online foreign exchange transactions has exceeded 98%. |