■ Sustainable Lending Business

Global temperatures continue to rise, and extreme climate events are becoming more frequent. Climate change has become a major global risk issue, and countries around the world have proposed carbon reduction targets. Taiwan's government has also formulated the Green Finance Action Plan 3.0 to encourage financial institutions to use funds to support the sustainable development of industries and enterprises. E.SUN Bank has long been committed to environmental sustainability and responds to international trends and domestic policies, by continuously supporting corporate sustainability transformation and promoting industry progress towards net-zero targets through green credit, sustainability-linked loans, and ESG industries credit.

Balance unit: NT$ million

| Sustainable lending |

Outstanding balance as of 2021 |

Outstanding balance as of 2022 |

| Green Loans |

|

18,726 |

53,741 |

| Sustainable-Linked Loans |

|

10,681 |

40,642 |

| Total value of sustainable lending |

|

29,407 |

94,383 |

| Total value of corporate lending |

|

782,957 |

866,051 |

| Percentage over total corporate lending |

|

3.76% |

10.90% |

Loans to ESG Industries

In 2022, E.SUN continued to invest resources in industries that are friendly to the environment and society, such as industries involved in green power generation, energy conservation and environmental protection, circular economy, medical care and education, and supported key industrial development policies promulgated by the government.

(NT$M)

| Loans to ESG industries |

Industry categories |

Outstanding loan balance as of 2021 |

Outstanding loan balance as of 2022 |

| Environmental-friendly Industries |

Solar power |

883 |

1,055 |

| Bicycles |

6,000 |

7,112 |

| LED |

729 |

732 |

| Batteries |

2,576 |

2,929 |

| Electric vehicles |

353 |

114 |

| Circular economy |

3,144 |

3,439 |

| Social-friendly Industries |

Medical care |

22,733 |

24,454 |

| Education |

7,105 |

6,161 |

| Sports & Fitness |

4,206 |

4,360 |

| Telecommunications and fixed network |

3,540 |

4,176 |

| Network communications and internet |

4,924 |

6,456 |

| Industrial robots |

83 |

17 |

| Innovative industries* |

5+2 Innovative Industries and supply chains |

205,188 |

211,410 |

|

Total loans to ESG industries |

261,464 |

272,415 |

* Based on the definition of the government's 5+2 Innovative Industries, while excluding the defense sector and sub-industries with higher sustainability risks in the related supply chain (such as cement, plastic, steel, etc.). Overlapped lending has been excluded.

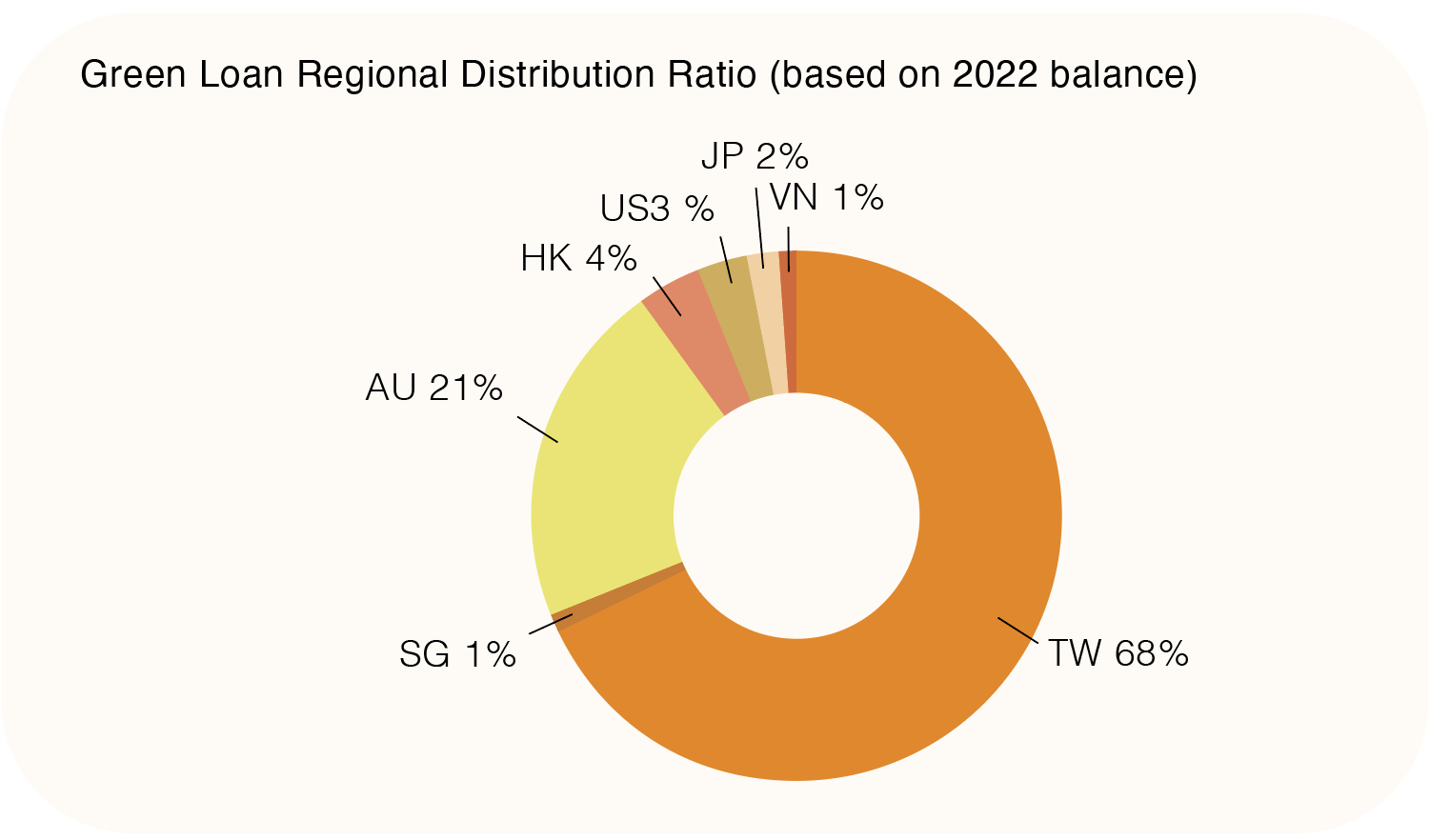

Green Loans

E.SUN established relevant bylaws and regulations with reference to the Loan Market Association's Green Loan Principles. The purpose of this is to support business sustainability and extend green loans for green projects to assist enterprises in investing in clean energy, energy storage systems, water resources and environmental pollution control, environmental protection products or equipment, and green buildings, etc. As of 2022, the balance totaled NT$53.7 billion, with an annual growth of 133%.

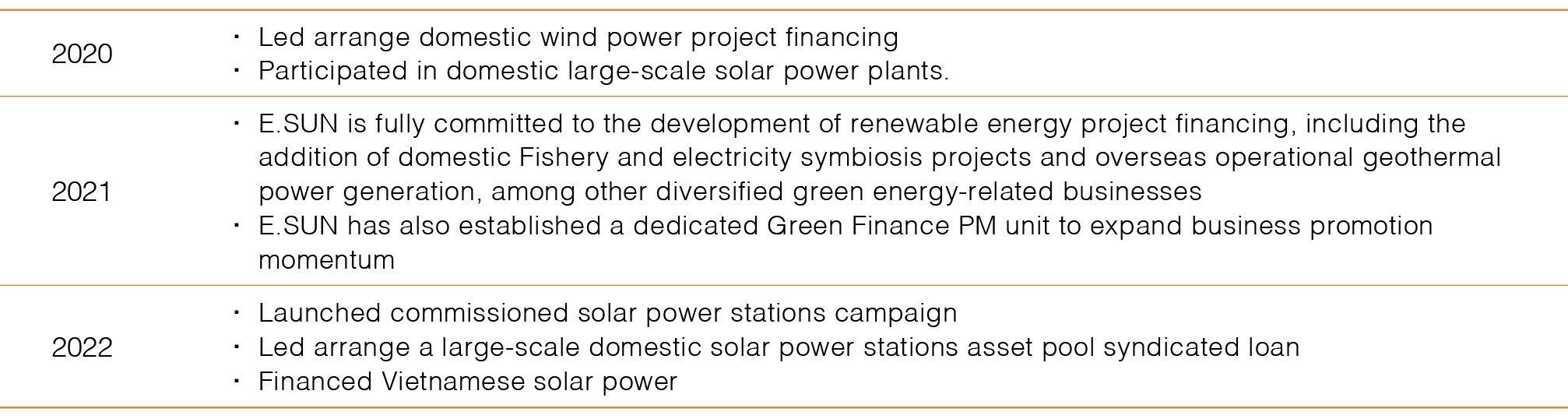

Development in the past three years:

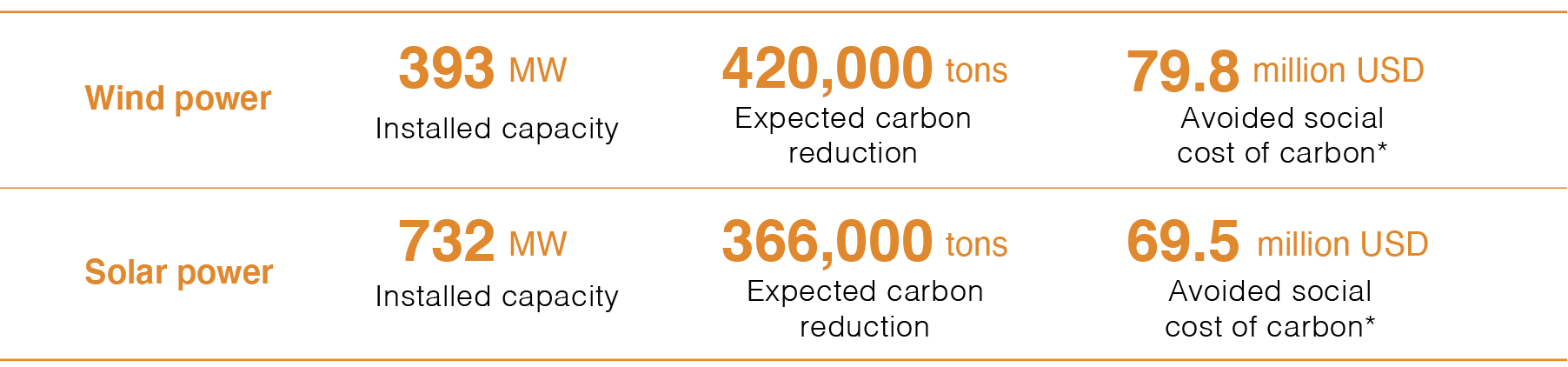

* Installed capacity: In 2022, the disclosure method was adjusted, and the supported project site installed capacity was recognized according to the credit amount participation ratio of the case (i.e., allocated amount/total project amount). If calculated according to the new disclosure method, the installed capacity of wind power and solar photovoltaic in 2021 should be 398MW and 353MW, respectively.

* Expected carbon reduction: According to the installed capacity of the project site supported by E.SUN (including projects under construction) × 80% (financing ratio) × 8,760 hours × wind power capacity

* Social cost of carbon is calculated by $190 USD/ton of CO2, based on the research data in "Report on the Social Cost of Greenhouse Gases"(U.S. EPA, 2022)

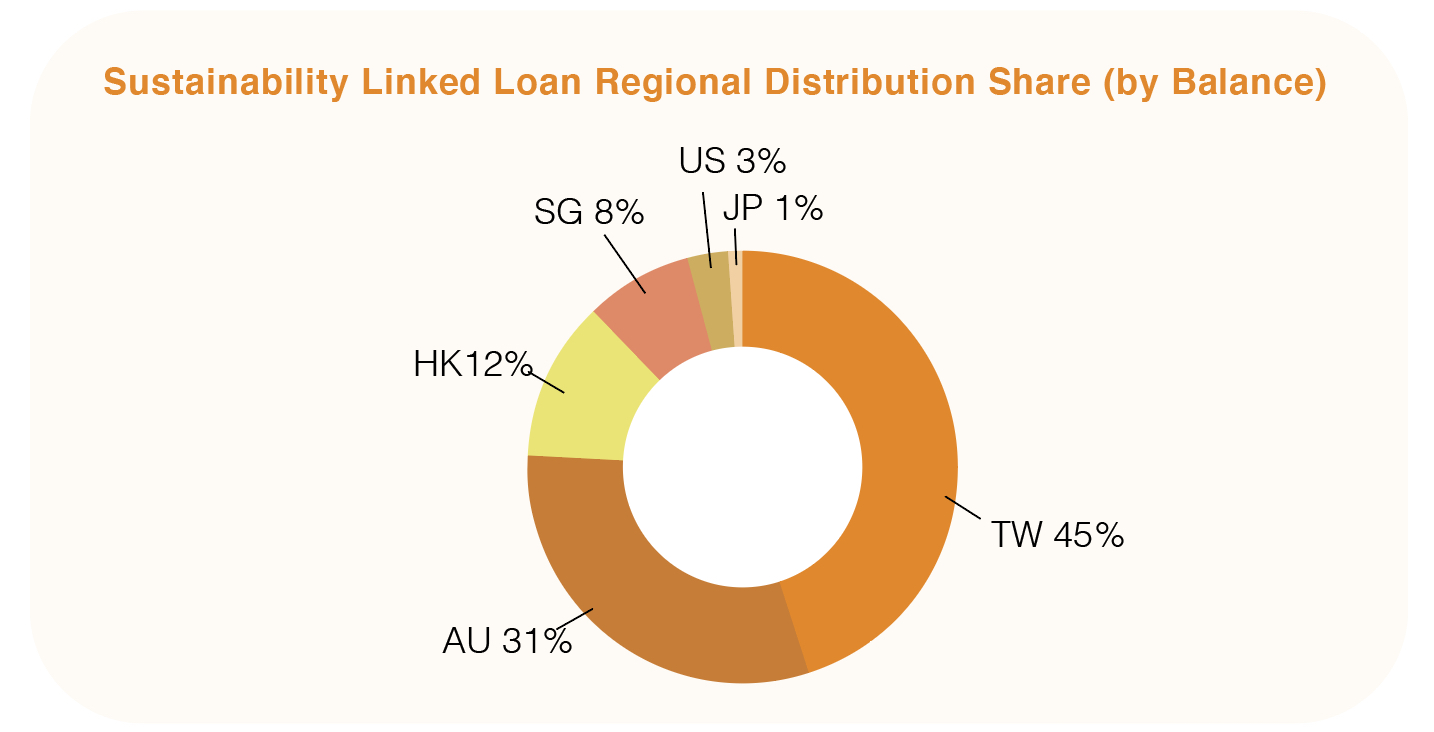

Sustainability Linked Loans

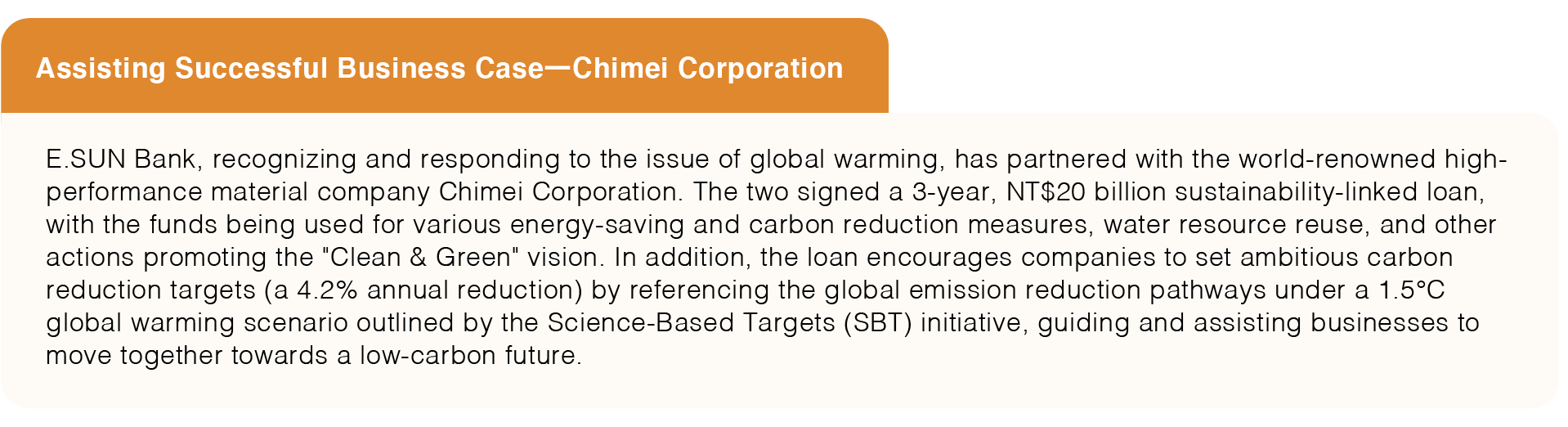

To encourage companies to establish and achieve ESG development goals, and to continue investing in sustainability-related initiatives, E.SUN Bank refers to the LMA Sustainability Linked Loan Principles, designs relevant regulations and operating procedures, and establishes an ESG assessment form. We evaluate the company's actual investment in ESG, sets sustainable development goals through joint discussions with companies, and provides financial service benefits if the company achieves those goals. By 2022, a total of 139 cases have been approved, with a balance of NT$40.6 billion (NT$10.7 billion in 2021). In 2023, E.SUN will continue to promote sustainability linked loans, encouraging more companies to set ESG goals, while incorporating performance into the evaluation of business units to guide them to grasp customer sustainability development progress, and enhancing their impact on the environment and society.

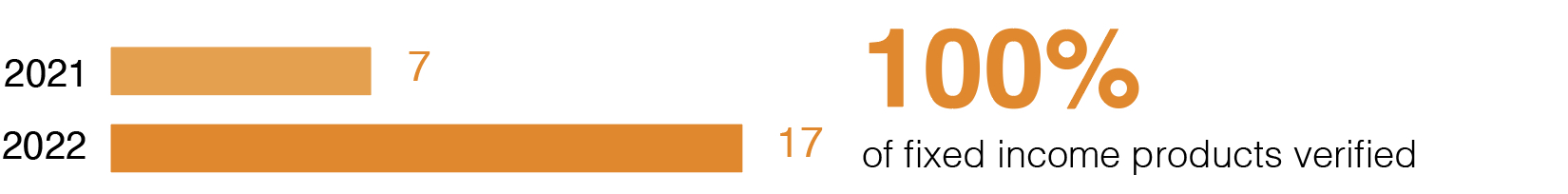

■ Sustainable Investment Business

2022 Results

E.SUN continues to invest in environment- and community-friendly industries. In 2022, E.SUN issued 1 social bond with a total amount of NT$1.1 billion for the first time, along with NT$7.3 billion worth of green bonds. Following the issuance of the country's first green bond in 2017 with a total of 7 NT Dollar Denominated and 1 U.S. Dollar Denominated sustainable bonds, E.SUN ranks first among Taiwan's domestic banks in terms of the sustainable bonds issuance scale. E.SUN adopts a financial management strategy that integrates the concept of sustainable development, the funds raised are lent to support green investment plans involving renewable energy, greenhouse gas reduction, and water resource conservation, as well as socially beneficial investment plans such as basic service requirements, affordable housing, socioeconomic advancement, and protection of interests and rights.

Sustainable Bonds issuance

| Green Bonds |

USD |

60,000,000 |

| TWD |

14,400,000,000 |

| Sustainability Bonds |

TWD |

1,600,000,000 |

| Social Bonds |

TWD |

1,100,000,000 |

| 2022 Sustainable Bonds issuance volume |

TWD |

8,400,000,000 |

| 2022 bonds issuance volume |

TWD |

13,400,000,000 |

| Percentage over total bonds issuance |

|

62.69% |

E.SUN assists companies to raise funds for sustainable development goals. In recent years, E.SUN has acted as the underwriter of 22 green bonds, 7 sustainability bonds, and 2 social bonds, with a total underwriting amount of approximately NT$8.8 billion in 2022, accumulating a total of more than NT$23 billion by the end of 2022. Through its competence in the financial industry, E.SUN helps companies fulfill their needs in ESG and make contribution to Taiwan's sustainable development, continuing to expand the underwriting volume at an annual rate of 23.26% in 2022, striving to become the top brand in sustainable bond market.

Sustainable Bonds underwriting

| 2022 Sustainable Bonds underwriting volume |

TWD |

8,807,928,000 |

| 2022 overall Sustainable Bonds volume |

TWD |

113,442,338,000 |

| Proportion of underwriting volume in the year |

|

7.76% |

E.SUN provides advisory services through underwriting sustainable bond process as well as financing offshore wind power and solar power projects. Green energy is the key to Net-Zero Emissions, the development of zero-carbon energy sources such as offshore wind power and solar power can promote the transformation of energy and power supply structures to low-carbon or zero-carbon structures. E.SUN provides sustainability related project hedging services and financial services to support environmentally friendly projects. In 2022, E.SUN provided Interest Rate Swap (IRS) hedging services for 5 new offshore wind power and solar energy project finance, worth NT$6.8 billion, accumulating a total of approximately NT$18.6 billion by the end of 2022. E.SUN will continue to unleash its financial expertise to exert its influence and assist enterprises in implementing environmentally friendly projects and giving full support to government policies.

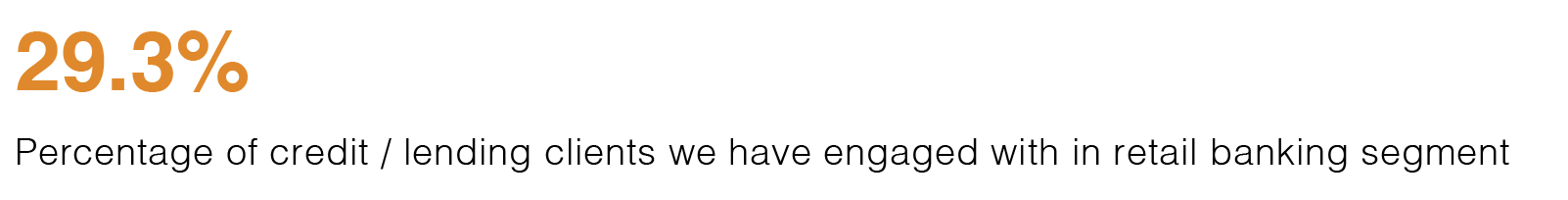

■ Retail Banking

Sustainable Loans and Mortgages

E.SUN pays constant attention to environmental and social issues and launches a diverse range of ESG loans and mortgages to help customers build their beautiful and sustainable home. These products include "green buildings mortgage," " solar roof loan," " electric vehicle loan," and"care-free mortgage" As of the end of 2022, E.SUN assisted more than 11,557 customers in achieving their sustainable ideals. The balance of sustainable loans and mortgages reached NT$121.16 billion, accounting for 12.55% of the total retail banking balance.

(NT$M)

| Dimensions |

Loan and Mortgage Projects that promote sustainability |

2022 |

Percentage of the total retail banking balance (%) |

| Number of cases |

Loan balance |

| Environment |

Green buildings mortgage

(Promotes purchase of certified green buildings) |

760 |

11,338.26 |

12.55 % |

Solar roof loan

(Assists individual households or small business in setting up rooftop solar power generation equipment) |

5 |

11.64 |

Electric vehicle loan

(Encourages the purchase of electric vehicles) |

2 |

5.37 |

| Society |

Care-free mortgage

(Provides young people and lower income families with affordable housing solutions, granting them housing subsidies and grace periods to assist them in forming their own families.) |

11,155 |

108,720.86 |

Reconstruction of urban unsafe and old buildings loan

(Responds to the government's policy, and assists customers in rebuilding unsafe and old houses to enhance their living safety) |

49 |

822.63 |

New Immigrants Dream Loan

(Assists new immigrants in meeting their financial needs for work and life in Taiwan) |

269 |

267.88 |

|

Total number of cases and loan balance |

11,557 |

121,167 |

【Retail banking business】-

2022 ESG-related Products and Number of Individual Customer Participating

| Item |

Description |

Number of customers participating |

Number of customer |

| Reconstruction of urban unsafe and old buildings loan |

We will engage customers to reconstruct old buildings into modern, eco-friendly, and energy efficient housing that meets social needs. It will also improve the overall quality and functionality of urban areas for daily life and improve the safety of housing. |

21 |

117,379 |

| Green buildings mortgage |

We encourage customers to choose eco-friendly, energy efficient green buildings that generate less waste when purchasing houses. |

335 |

| ESG credit cards |

A portion of revenue from credit card payments is used to construct libraries in rural areas and support environmental and wildlife conservation. |

115,161 |

| Green consumption |

For World Earth Day, we encourage customers to purchase electric scooters, organic food products, and eco-friendly products. |

3,222 |

| Credit / lending clients in retail banking segment |

Number of customers approved for mortgages, credit loans, and credit cards in 2022. |

- |

400,535 |

■ Inclusive Finance

Dementia-Friendly Financial Plan

E.SUN has partnered with the Taipei City Hospital to promote a dementia-friendly plan. The Interdisciplinary Immersive Education Development Center of Taipei Hospital integrates neurologists, clinical psychologists, and standardized teachers to provide professional courses on dementia trends and empathetic services to E.SUN employees using innovative simulation training modules. Employees interact with trained standardized teachers to enhance the service skills of "watching, asking, staying, and calling": watching - identifying people with dementia, asking - discovering and addressing their needs, staying - providing appropriate assistance, and calling - notifying their family or relevant authorities. This improves employees' recognition and empathetic services for customers with dementia.

Inclusive Finance Wealth Management Product - Microinsurance

Disadvantaged and underserved groups

In 2022, E.SUN cooperated with insurance companies and county/city governments to expand the impact of microinsurance, by assisting economically disadvantaged and special status individuals to obtain basic insurance coverage with lower premiums. This includes providing basic microinsurance for economically disadvantaged elderly aged 65-75 in Tainan City with estimated over 8,000 beneficiaries, and for low-income households, the near-poor households, and individuals with impairments in Hualien County, protecting disadvantaged families and covering their daily needs.

(NT$ Thousand)

| Insurance Products |

Targeted Clients |

Number of Cases |

Premium |

| Microinsurance |

Economically disadvantaged individuals with specific status and their family members:

1. Low-income and the near-poor individuals

2. Indigenous people, farmers, fishermen

3. Individuals with impairments

4. Family members mentioned above

|

52 |

17 |

| Small Amount Whole Life Insurance |

- 1. People with limited budget

- 2. Elderly people

- 3. Fresh graduates

|

17 |

792 |

| Spillover-effect Insurance |

Health-conscious people |

1,238 |

22,986 |

|

Total |

1,307 |

23,795 |

Inclusive Finance Loan Product

Provide comprehensive financial services to support the development of microbusinesses.

Provide comprehensive financial services to support the development of microbusinesses.

Acquiring funds has always been a huge challenge for SMEs, and for microbusinesses, it is even more critical to their stable operation. E.SUN issues social bonds to provide the necessary funds for microbusiness operations. Through three major actions - "business financial advisory, funding assistance, and efficient services" E.SUN helps enterprises strengthen their financial structure, quickly provides capital using digital technology, and supports their growth.

- Business financial advisory : E.SUN collaborates with cross-industry partners (e.g., Taiwan regional revitalization foundation, Townway, etc.) to hold financial seminars, helping over 20 start-up teams establish basic knowledge for business operations, financial planning and management skills.

- Funding assistance: By integrating resources from Taiwan SMEG(Small & Medium Enterprise Credit Gurantee Fund of Taiwan), E.SUN develops diverse financing plans for enterprises at different stages of development (startup, growth, maturity).

- Efficient services: Utilizing AI and digital technology, E.SUN offers microbusinesses online loan calculation services, allowing business owners to quickly obtain loan amount and interest rate information without time and space constraints.

Impact valuation

Note: The reduced social cost is calculated as the number of total clients of small business loan x average number of small business employees x unemployment benefits for each unemployed person

Inclusive finance loan product

(NT$ Million)

| Project |

Targeted Clients |

2020 |

2021 |

2022 |

| Number of clients |

Amount |

Number of clients |

Amount |

Number of clients |

Amount |

Startup loan

Helping star-ups sustain by offering quick access to financing |

Microbusinesses |

2,592 |

2,182 |

2,871 |

2,069 |

2,523 |

1,606 |

Distinct local business loan

Providing financing exclusively to businesses with local characteristics, balancing the gap between urban and rural |

1,099 |

5,891 |

1,160 |

5,469 |

1,181 |

5,316 |

Social innovation enterprise loan(Smile & Hope Loan included)

Helping social enterprises and social innovation enterprises grow and become financially healthy |

21 |

70 |

26 |

79 |

45 |

112 |

Commercial mortgage

Loan for procurement of office and manufacturing facility |

4,137 |

36,906 |

4,042 |

37,527 |

3,957 |

37,981 |

Working capital loan

Working capital for small businesses |

16,064 |

64,903 |

17,614 |

64,991 |

17,760 |

66,183 |

|

|

|

|

Total Number of

clients and amount |

19,267 |

104,164 |

Residential subsidy loans

Assisting low-income families with home improvement and home purchases |

Poor and low-income individuals |

874 |

1,300 |

993 |

1,496 |

1,154 |

1,759 |

Debt negotiation and repayment plan services

Debt restructuring for families facing incidents |

1,768 |

248 |

2,951 |

995 |

1,826 |

495 |

Earthquake disaster victims

Post-disaster reconstruction loan service |

21 |

14 |

17 |

11 |

14 |

8 |

|

|

|

|

Total Number of

clients and amount |

2,994 |

2,262 |

Student loans

Assisting outstanding students in financing their overseas studies |

Young people |

288 |

200 |

284 |

197 |

285 |

191 |

Loans for startup funding for young entrepreneurs

Assisting young start-up entrepreneurs to build their businesses and creating a conducive environment |

206 |

85 |

373 |

178 |

521 |

242 |

|

|

|

|

Total Number of

clients and amount |

806 |

433 |

Reverse mortgage

Helping the elderly to revitalize their real estate and regularly allocating stable living funds |

Elderly people |

- |

- |

- |

- |

3 |

2.45 |

|

|

|

|

Total Number of clients and amount |

23,069 |

106,861 |

■ FinTech and Innovation

E.SUN has long focused on fintech development, with a

technology team of over 1,300 experts responsible for overall digital development,

intelligent applications, IT research, and data security management. Through

cross-team collaboration and continuous improvement, E.SUN enhanced digital

financial technology efficiency. Information acts like the organization's nervous

system, AI serves as the brain, digital is the agile limbs, and data security is the

immune system. Only by having all these elements can a stable organic system be

formed. Being the first bank in Taiwan to apply artificial intelligence deeply to

various businesses and to build a core system with open cloud-native technology and

microservices architecture, E.SUN has achieved remarkable results in intelligent

finance, inclusive finance, and scenario-based finance. In recent years, E.SUN has

actively introduced agile methodologies and explored cloud computing applications.

In the past three years, more than 80% of fund purchases, 96% of loan applications,

and 99% of foreign exchange transactions have been completed through digital

channels, with the active number of e.Fingo digital members reaching 97%. Specific

achievements are as follows:

■ Services Supported

Digital foundation

Capitalizing on the technological capacity of E.SUN, we

continue to develop infrastructures for digital transformation and endeavor to

fulfill our sustainability commitments by adopting eco-friendly practices,

conserving energy, and creating the value of environmental sustainability.

| Topics |

Strategy Directions |

| AI Technology |

AI Cloud is the main research and development

environment in E.SUN AI, providing data scientists with a platform for

data processing, modeling, testing, and sharing. It is an innovative

sandbox that has nurtured many mature and stable AI models.

|

| E.SUN's self-built MLaaS (Machine Learning as a Service) platform has provided more than 50 AI services, allowing developers to quickly and flexibly deploy and use APIs of AI models, becoming an important bridge connecting mature AI models and business systems. |

| Operational Resilience |

To improve the quality of digital infrastructures,

E.SUN builds SD-WAN network architecture for overseas branches. |

|

Resource efficiency

|

Provide the virtualization, private cloud environment and implement

monitoring management tools to allocate IT resource more efficiently.

|

|

In order to increase productivity, we implement the collaboration

platforms in development process and digital tools. |

|

Agility and Resilience

|

From 2022, enlarging the use of container platform

and reserving the flexibility of using public clouds. |

|

Cloud Service has the diversity and high availability, and complement

with on-premises services, more information service requests will be

achieved by using both cloud and on-premises service. At the same time,

the security of using cloud services is ensured through a security

management framework.

|

| Security Monitoring |

Improving existing processes and utilizing

automated integration technology to accelerate incident response times

and enhance the SOC's (Security Operation Center) proactive

cybersecurity monitoring team's incident response and investigation

skills, expand the overall risk visibility, and effectively reduce the

impact of incidents. |

Protecting Patented

Technology

As a pioneer of financial technology and digital

transformation, E.SUN adopted the Taiwan Intellectual Property Management System

(TIPS) in 2020, and passed the TIPS A-Level verification. Through intellectual

property risk assessment, patent proposal review mechanism, proposal rewards,

intellectual property-related advocacy education, and talent training, E.SUN

implements intelligent services and technical advantages.

|

Invention patents |

Utility patents |

Design patents |

| Announced in 2022 |

23 |

16 |

11 |

| As of the end of 2022 |

54 |

76 |

22 |

E.SUN's patents cover areas such as data control and

information security, identity verification, payment, AI application, interface

design, and more. These innovations are applied to create innovative financial

services, providing customers with convenient, fast, and secure experiences. Our

significant digital business proportion leads Asian financial banks. E.SUN will

continue to protect the intellectual property rights of various core businesses,

strengthen the business development foundation, and promote corporate governance to

move towards sustainable development.

Financial Innovation

Applications

Digital Process Optimization, Service Without Interruption

| Optimization of digital account

opening process experience |

Using Intelligent models to identify high-risk

customers and applying two sets of OCR (Optical Character Recognition)

technology for cross-checking document information, along with the use

of RPA (Robotic Process Automation) technology and optimizing the

approval process to reduce repetitive manual review and release manpower

time, the fastest time required for human review is just 3.1 minutes per

case, reducing the waiting time of customers by 80% and down to 4 hours.

|

| Sinyi Realty - Property Automated Valuation

Cooperation |

In 2022, E.SUN collaborated with Sinyi Realty,

allowing customers to obtain the trial calculation results of E.SUN's

property automated valuation model 24/7, shortening the waiting time for

manual assessment of amounts and interest rate of mortgages and

optimizing service experience. |

| E.SUN Mobile Banking |

E.SUN Mobile Banking integrates multiple

innovative services, obtaining 11 design patents, 17 new model patents,

and 7 invention patents. We achieved high growth in both the number of

digital users and the frequency of digital interaction, with over 70% of

active users using mobile banking, and will continue to focus on the

customer experience and provide diverse services:

(1)Multiple Authentication Modules: We offer up to 9 types of

verification methods, including voice OTP, SIM card authentication, ATM

verification code, and face/fingerprint recognition. Customers can

freely choose verification methods according to their habits, scenarios,

and services while ensuring transaction safety.

(2)Contactless Integrated Financial Services: Customers can use video

services to apply for various financial services through E.SUN Mobile

Banking, and complete financial transactions with one click through

E.SUN's "Fast and Easy Wealth Management" service. Break the limitations

of time and space to create a friendly new financial milestone. |

| E.SUN Wallet |

E.SUN Bank has opened E.SUN electronic payment

services to both E.SUN Bank customers and non-customers through E.SUN

Wallet, expanding the accessibility of E.SUN Wallet's financial

services. It has become Taiwan's first digital platform jointly owned by

a bank and an electronic payment service provider. In addition, E.SUN

Wallet has added the functionality of linking with a E.SUN Bank account

or loading their E.SUN credit cards for payment. This expansion has

increased E.SUN Wallet's payment coverage from credit cards to all 250

thousand channels of Taiwan Pay. E.SUN also created the first card

number checking service on a payment App in Taiwan. This means that

cardholders can shop at physical and digital channels by loading their

card number onto the E.SUN Wallet App and international mobile payment

services before they receive their physical cards. |

| E.SUN Extremely Fast Revolving Loan |

E.SUN Bank offers customers flexible small loan choices. Customers can decide on their desired loan amount and repayment period, and interest is only calculated on the amount utilized. This meets the needs of short-term cash flow or daily expenses.

|